Manage your own portfolio and invest in bridging loans or properties that suit your investment profile. Select, find out more, and pledge within the TAB Market.

Our technology solutions allow us to deliver quotes on bespoke finance based on the potential of each project within 24 hours at any time of the year. We pride ourselves on a quick turnaround and responsiveness to real-time changes within the property market.

I am a borrower I am an intermediaryTotal lent

Total invested

Capital repaid

Average gross LTV

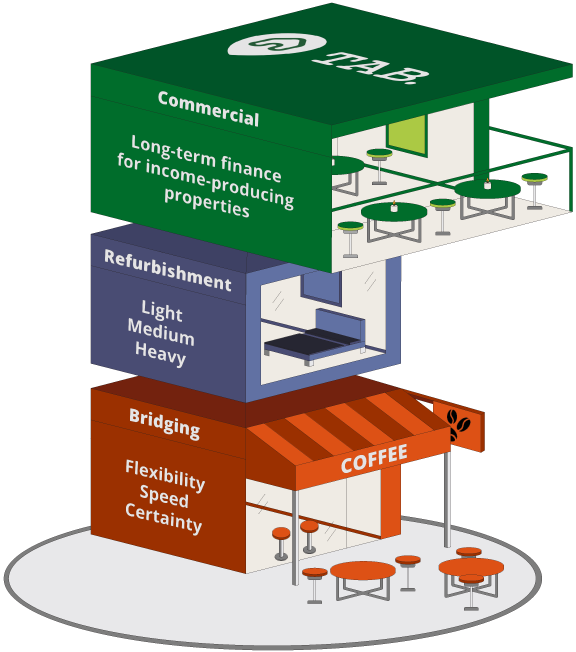

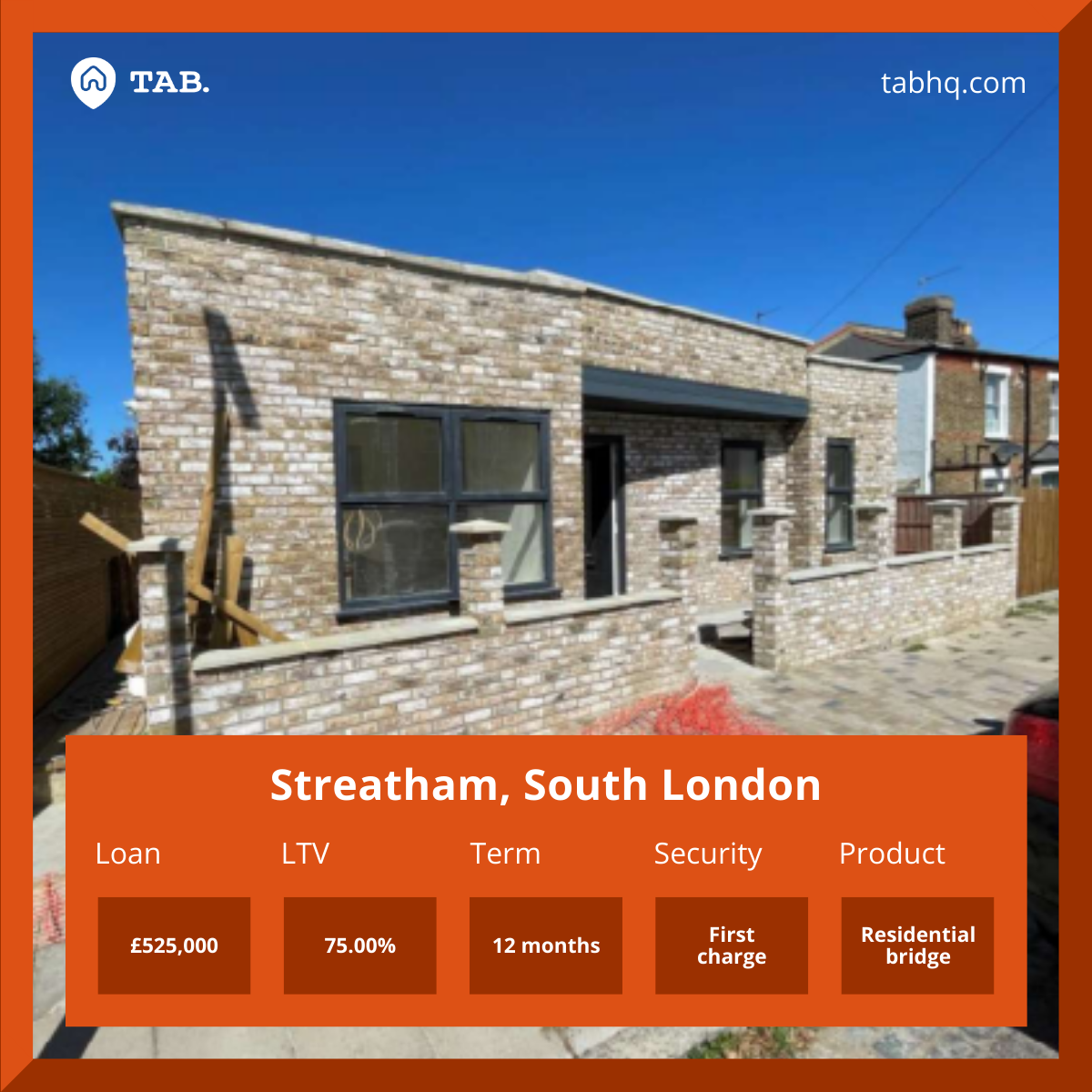

TAB provides bridging loans for property projects. We understand short term lending requirements and have the experience to transact swiftly while taking a prudent approach to risk. We match people who want to borrow with people who want to invest.

TAB’s foundations are built on our key values, trust and transparency, while giving customers a personalised and efficient experience. The decades of property market experience, in-house legal team, quality underwriters and high-level salespeople behind the TAB team have allowed us to grow our loan book to almost £321m within the space of three years. Working out of our North London offices, our small but agile team cultivates a collaborative environment where we can learn from each other to ensure we’re constantly improving and evolving our service. As our team grows, we shall continue to improve, share knowledge, and commit to remaining efficient and providing the best service possible.

The TAB Market is where you can find TAB fractional property investment opportunities. If you want to stay tuned and get alerts when loans and properties are available you can sign up to our mailing list

We have decades of lending experience and our technology solutions allow us to execute deals quickly and efficiently. This means we have an ample stream of investment opportunities for our investors.

Capital is at risk. Interest and income payments are not guaranteed. TAB Property returns can go down as well as up. Past performance and forecasts are not reliable indicators of future results and should not be relied on. Before investing read key risks here.

Invest in property backed bridging loans. Select terms that suit your investment goals.

Part own a share of property through fractional ownership. Receive rental income and potential capital appreciation.

Sign up with your name and email address.

Take our short investment quiz. We want to make sure you know what risks are involved when investing with TAB.

We need to make sure you are who you say you are, and we need a few more bits of detail for our AML and KYC checks. This is also where you’ll confirm what type of account you require.

On TAB Market you can see which open loan opportunities there are. To invest in one you that you like, you can pledge an amount. Invest from £1,000.

Once your pledge has been confirmed, our finance team will get in touch to arrange the transfer of funds. Once you’ve sent funds, that’s it! You’ll start earning monthly interest.

TAB have a number of different types of accounts you can open. You can open an account whether you’re an individual or a couple, and want to manage your portfolio together. You can view the types of accounts you can open below:

View TAB accountsYou can sign up for our newsletter and stay in the know about TAB and what’s been going on here. Alternatively, follow us on our social media sites, or visit our TAB news website.

Due to the short term nature of a bridging loan, the sum of money borrowed is due for repayment according to the terms that are agreed upon before the loan is completed. Interest is charged on bridging loans which is calculated on a monthly basis. Interest can be paid in one of two ways. Either monthly (serviced) or retained (unserviced). Retained means the total cost of the interest will be rolled up and added to the initial lump sum borrowed and due for repayment at the end of the loan term.

Bridging finance could be a viable option for you. Whether you’re a residential buyer, property developer, or property investor there is no cookie cutter approach to bridging finance, which is what makes it an ideal solution for so many different financial circumstances.

It should be noted, however, that you can also get different types of bridging loans. You can get regulated and unregulated bridging loans. Regulated loans are regulated by the FCA while unregulated ones are not. Put simply - a regulated bridging loan is a loan that is secured against a property that the borrower (or their immediate family) currently or intends to occupy. In contrast, bridging loans are unregulated where the secured property is for an investment or business purpose. Any property used as security is at risk of repossession if you do not keep up with your payments. If you are unsure of the risks, you are advised to obtain appropriate professional advice.

At TAB we know that every borrower is unique. We have the flexibility to consider the broadest range of circumstances and the property market experience to recognize potential where traditional lenders see risk. Our typical loans include refurbishment property or redevelopment loans for properties of all sizes and complexity. Property development loans for completed and nearly completed projects in need of extra finance. Bridging loans for auction completions. Commercial bridging loans for those wanting to expand their property portfolios and mortgage bridging loans, when traditional lenders can’t complete quickly enough.

A bridging loan is a short-term secured property loan that typically lasts between three - 24 months. It is designed to bridge the gap in your finances until a long term financial solution can be sought or additional funds are received from an alternative source, such as a property sale.

For more information you can view our full list of frequently asked questions here.