TAB Lending is an investment into a short-term loan. The loans are secured against UK commercial and residential property. You have the ability to select the TAB Lending loan that best suits your investment needs. TAB Lending covers bridging loans, land with planning loans and also development loans. You can learn more about TAB Lending and how it works here.

TAB does not currently offer a secondary market or other facility which allows you to transfer or exit your investment early. Once you invest, you are committed for the full period. TAB will be launching a secondary market TAB Exchange in the future. However, no date has been set and you should not rely on it being available to you during the period of any investments you make today.

TAB understands that lending requirements are different to all borrowers and our aim is to be flexible with our service, meaning we can offer different terms to meet their needs. Consequently, TAB Lending investments also have different terms, allowing you to invest in loans with terms and risk profiles that suit your investment goals and requirements.

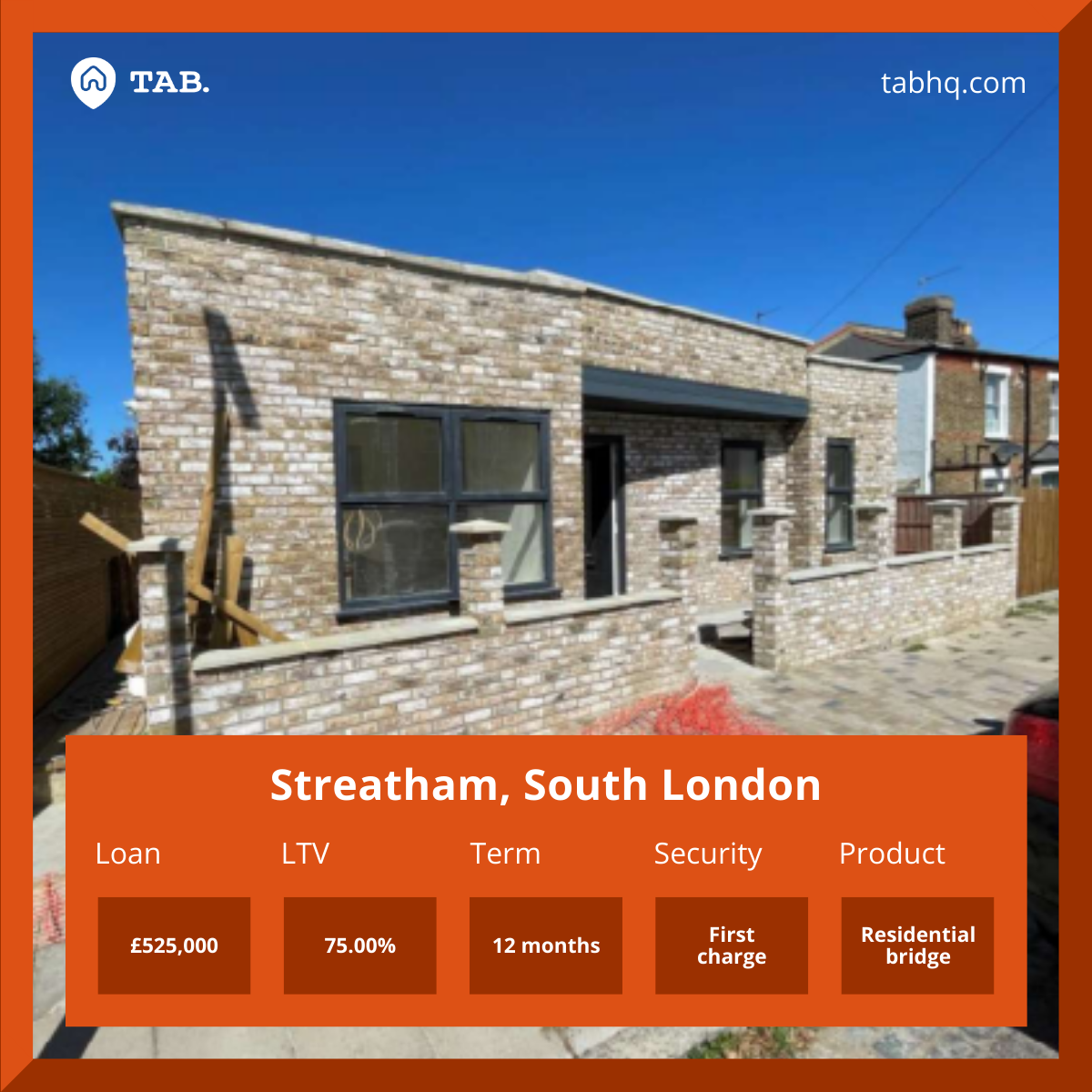

Each loan has its own TAB Lending card which provides highlights of each investment on the TAB Market. Full details of the investments are available on the investment details page which is accessible once you have registered for a TAB account. The investment details page will give you access to a third party valuation report, undertaken by a RICS accredited surveyor, the term sheet, borrower information, financials of the loan and any other information associated with the loan. The term sheet sets out the amount of the loan, its principal terms including duration, rate of interest, arrangements for repayment and servicing of interest by the borrower, details of the property over which the security is to be created and fees. You should read these alongside the Funding Agreement which sets out your general terms and conditions. If you have any questions about a TAB Lending investment and the investment details page please contact our investor relations team at help@tabhq.com.