What is property development finance?

TAB’s property development finance is a short-term funding solution for up to 24 months for projects based in London and the home counties. TAB property development loans are designed to unlock capital to assist with ground-up developments, conversions, heavy and light refurbishments and finish and exit property projects.

TAB lends directly to borrowers and through intermediaries. We offer loans up to 65% of the gross development value of your project, including the cost of borrowing. The maximum loan to cost can be up to 100% for the appropriate project. Our experience means we can be flexible with our valuations and consider projects that more traditional lenders would not. We pride ourselves on trust and transparency.

TAB loans are unregulated. Any property used as security is at risk of repossession if you do not keep up with your payments.

Development funding product details

Other charges may apply

Frequently asked questions

Property development finance is a short term loan for residential or commercial property developments, such as ground up construction projects or refurbishment projects, typically based on the future value of the development when completed - gross development value (GDV).

You might opt to use property development finance over a bank loan as the larger banks are constrained to box-ticking when it comes to lending and it can be extremely difficult to source development finance. Property development finance is a bespoke product and has specialist teams working behind the scenes to understand all of the risks and parameters that need to be considered when lending. It’s essential for lenders to have complete oversight of the project and often these high street banks do not have the time, nor expertise to understand financing property development and the nuances between projects.

Both are forms of alternative finance, but it is better to look at development finance and bridging finance separately. Residential Bridging loans are commonly used to ‘bridge’ a gap, such as purchasing a property when the previous hadn’t sold. You can release the equity on your current property, allowing you the finance to secure another. So, where bridging finance is used to purchase a property, development finance is better suited to adding value to the property, whether that’s building from scratch, renovating or carrying out a change of use.

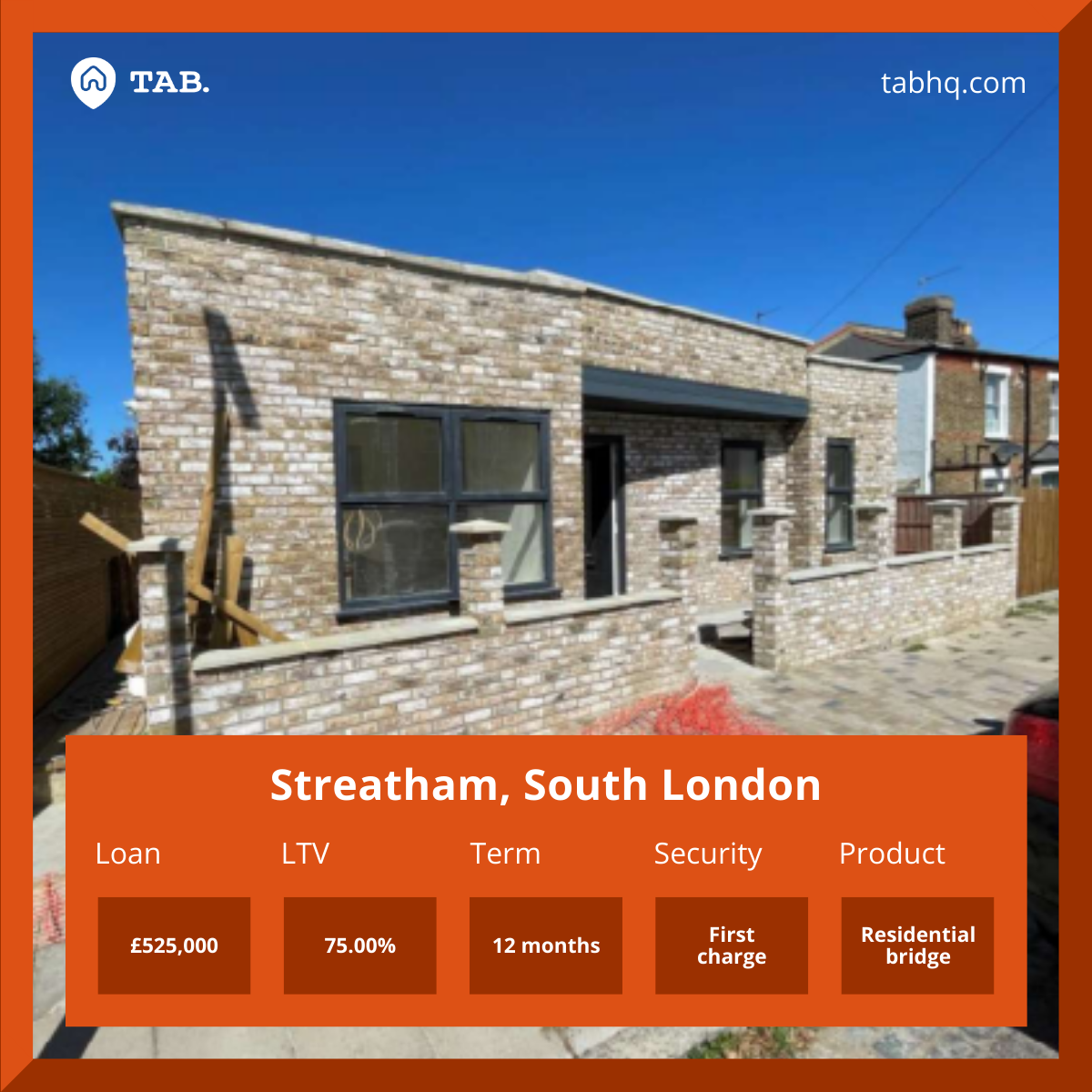

Acton, London: The client required development loan of £457,357 of an overall facility of £950,000 to develop an existing 1930’s purpose built block of flats which is arranged over ground and two upper floors by adding an extra floor. TAB provided the loan at a 43.78% LTGDV for 14 months.

For more information you can view our full list of frequently asked questions here.

How it works

Borrower applies

Following an initial enquiry, borrowers apply for a loan through our application process.Decision made

Our team undertakes their due diligence and underwriting process on the borrower, the security property and the project. Terms are then agreed.Perfect match

The loan is then matched with investors on the TAB platform. Funds are typically available within just 14 days